Offsetting Carbon vs Insetting Carbon

What does it mean to offset or inset our emissions?

Almost all companies are looking to reduce carbon emissions. Still, the majority cannot reach carbon neutrality or attain the coveted ‘Net Zero Carbon’ status because they don’t want to or can’t change practices quickly. So, they offset their carbon emissions by investing in projects that remove carbon from the atmosphere, including renewable energy, restoring biodiversity, and agroforestry elsewhere, often in other continents. But could insetting carbon become a better bridge until businesses and organisations truly get their act together? We looked deeper into carbon insetting and how it differs from carbon offsetting.

Carbon offsetting requires a business to fund projects outside of its operational control. Credits are purchased to fund projects that help remove carbon from the atmosphere. When the number of carbon credits obtained equals an organisation’s carbon footprint, they become carbon neutral. Offsetting provides convenience and economic efficiency; it is simple, quick and does some good somewhere, therefore appealing to most businesses.

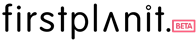

Carbon insetting is a concept that has recently gained significant traction; organisations offset carbon emissions by investing in projects within their value chain. ’Pur projet’, a pioneer in insetting, describes the process as evaluating, reducing and offsetting a company’s climate and environmental footprint by developing impactful socio-environmental projects within its value chain and using them to build a sustainable society.

The diagram shows the impact and benefits of carbon insetting. Investing in resilient and regenerative practices can generate positive impacts, including GHG emissions reductions, increased agricultural productivity and biodiversity protection. The positive impacts, in turn, create benefits, including the achievement of climate targets and commitments and improving climate resilience in the value chain. This is the holistic approach to sustainability that carbon insetting offers.

What issue does carbon insetting address?

What are the problems with offsetting?

There are concerns that offsetting has become a crutch to achieving carbon targets (1). Critics claim it is like a bribe to absolve guilt and avoid structural changes to fundamentally unsustainable business models. Carbon credits were intended to address emissions we could not remove; instead, they enable business as usual. Greenpeace UK argues, “Purchasing carbon credits can be seen as an easy way out for governments, businesses and individuals to continue polluting without making changes to the way they do business or their behaviour”.

Issues surrounding offsetting prompted the Climate Change Committee (CCC) to advise the UK Government that ‘no more than 5% of emissions’ should be offset internationally to reach their net-zero targets. (1)

Why insetting could be a solution.

Insetting is internally focused; unlike offsetting, it funds the decarbonisation of the business and its supply chain. A distinction that almost certainly will celebrate companies acting on organisational transitions and improving their practices and supply chains. Carbon insetting builds stronger relationships among employees, customers, suppliers and local communities by direct investment in them towards healthy and sustainable business and operational practices.

Carbon offsetting is unsustainable business.

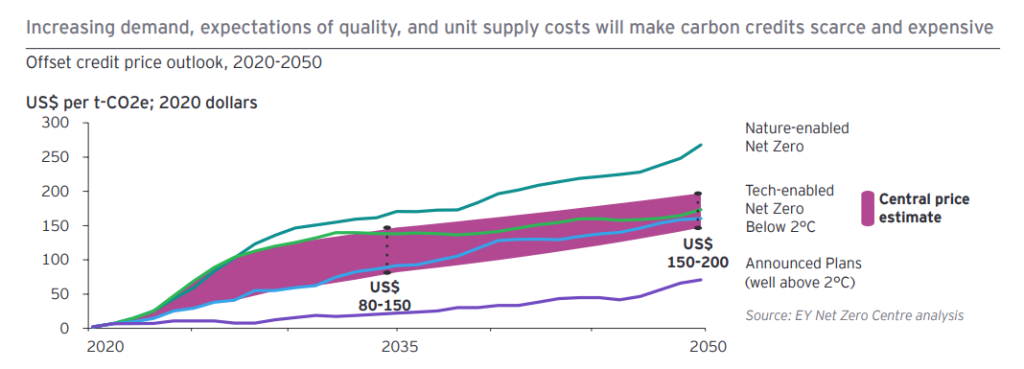

Another elephant in the room is cost and ROI. Carbon credits purchased today cost around $25 per tonne of CO2e. However, carbon credit demand is rising fast, and volume is set to increase 30 times the current supply by 2035 due to the global urgency around Net Zero targets. This will result in scarce and expensive carbon credits with a predicted rise to a central estimate of US$80-$150 per tonne by 2035 (4). This reliance is significant and risky. Businesses will be expected to make sacrifices elsewhere to pay for carbon offsets.

- Investing in better management of agricultural land and natural resources leads to better yields and a more reliable supply of raw materials.

- Investing in deeper engagements strengthens social commitment and associated brand value.

- Investing in and supporting sustainable and local suppliers for economic resilience along with carbon reduction.

- A paper by Ecometrica (2) also suggests insetting could extend to commuting or home insulation for employees, joint investment in energy efficiency projects with suppliers, or collective recycling schemes between companies within a neighbourhood or office complex.

What does Firstplanit think of this

Like carbon offsetting, insetting can only ever be part of a much broader push for reductions in emissions. That includes direct investments in efficiency, conservation and renewables; a shift away from fossil fuel investment and use; and a growth in advocacy for a low carbon economy.

Carbon insetting offers a different, more holistic, integrated approach to sustainable investment in GHG reduction outside of direct business activities. This approach also has the potential to alleviate the future economic burden of carbon credits whilst improving the resilience of supply chains.

Firstplanit helps the construction industry with this approach; as a decision-making tool, it can guide organisations in making their value chain more sustainable and investing in choosing more sustainable vendors. Our analysis of materials based on environmental impact can help companies align themselves with suppliers who share their values.

Sources

(1) Inspired Energy – https://inspiredenergy.co.uk/carbon-insetting-drive-down-scope-3-emissions/

(2) Ecometrica – https://ecometrica.com/assets//insetting_offsetting_technical.pdf

(3) IPI – https://www.insettingplatform.com/wp-content/uploads/2022/03/IPI-Insetting-Guide.pdf

(4) EY – https://assets.ey.com/content/dam/ey-sites/ey-com/en_au/topics/sustainability/ey-net-zero-centre-carbon-offset-publication-20220530.pdf

(5) The Guardian – https://www.theguardian.com/sustainable-business/2015/jan/09/carbon-offsetting-insetting-supply-chain